Whether you are a gamer yourself or are involved in the gaming industry, it is vital for you to stay on top of all of the latest trends. This means getting informed as far as the statistics that demonstrate what’s hot right now in the world of gaming.

This is especially critical if you are a video game developer or are hoping to enter the industry in the splashiest way possible. In order to make the biggest success, it’s important for you to know where the video game industry has come from, where it stands now and where it’s going.

Here is a closer look at some key metrics and their relation to the video game industry. Whether your interest is PC, console, social media or mobile games, you will find the data you need here.

Gaming Revenue by Country

While gaming is popular across the globe, there is no doubt that just a handful of countries account for the lion’s share of gaming revenue. China is the winner by far when it comes to turning a profit for the gaming industry.

- Newzoo estimates that citizens of that nation spent more than $34.4 billion on gaming in 2018. Of an estimated 1.4 billion citizens, some 850 million are connected to the Internet. This means that nearly 61 percent of the Chinese population may be participating in the gaming culture.

- Next on the list is the U.S. Newzoo reports in excess of $31.5 billion in gaming revenue for America in 2018. The country’s population is considerably smaller than China’s, coming in at just 327 million. However, more of the U.S. population is connected to the Internet.

- Because 265,000,000 Americans are Internet-connected, a whopping 81 percent of the population probably plays and pays for, games on a regular basis.

- Rounding out the top five countries in the findings are Japan, South Korea, and Germany. The close relationship between the population of these three countries and their Internet connectivity is astounding.

Of Japan’s 127 million citizens, 121 million are connected to the Internet. South Korea’s 51 million citizens are nearly all Internet-ready at 48 million. In Germany, 76 million of that country’s 82 million people spend a good portion of their time online. With almost entire countries being a potential part of the gaming market, these people cannot be ignored.

Here’s a more detailed look at those top five nations from Newzoo’s report:

| Rank | Nation | Internet Population | Revenue |

|---|---|---|---|

| 1 | China | 850 million | $34,400 million |

| 2 | US | 265 million | $31,535 million |

| 3 | Japan | 121 million | $17,715 million |

| 4 | South Korea | 48 million | $5,764 million |

| 5 | Germany | 76 million | $4,989 million |

Live Streaming Statistics

More and more households are cutting the cable cord in favor of streaming services, so you know that’s big business. Live streaming is somewhat related to this industry in that it involves viewing content that is broadcast over the Internet. The main difference is that live streaming typically refers to one-time special events like a concert, a boxing match or an awards ceremony.

Live streaming offers an incredible opportunity for people around the world to experience the same event as it is happening. Because it’s live, it seems like almost anything could happen. That is increasingly the case as more individuals begin live streaming on social media platforms as a means of reaching their audience.

Just how big is live streaming?

Top 5 Esports Broadcasters on YouTube:

- Riot: 77.00% (22.1 million)

- Vietnam Esports TV: 11.15% (3.2 million)

- Ligagame Esports: 5.23% (1.5 million)

- ESL: 3.48% (1 million)

- Garena: 3.14% (0.9 million)

Top 5 Esports Broadcasters on Twitch:

- Riot: 29.61% (42.4 million)

- Turner: 27.16% (38.9 million)

- Starladder: 18.85% (27 million)

- Ruhub: 12.22% (17.5 million)

- ESL: 12.15% (17.4 million)

The website researchandmarkets.com predicts that the live streaming market will be worth approximately $70 billion by 2021.

Growth in live video streaming has been incredibly fast. Vimeo found that in 2016, 81 percent of online audiences watched more live streams than they had in 2015. Approximately 56 percent of live content that viewers enjoyed was breaking news updates. Another 43 percent of live streaming content featured festivals, concerts, conferences, and speakers.

Where are people watching live streams? The current favorite appears to be Facebook Live. Statistics suggest that approximately two billion people have watched live stream events on the social media platform.

That’s even more viewers that have watched live streaming events on YouTube, probably because Facebook has a larger membership base.

Evidence suggests that live streaming may soon surpass popular sharing and communication efforts like blogging and posting on social media. The researchandmarkets.com website states that about 82 percent of viewers prefer watching a video to reading a post on social media.

Eighty percent would rather watch a live stream than take the time to read a blog.

If you are hoping to sell a product or service and want to use social media to promote your efforts, then statistics say that you should include a video. When a video is posted to a social media platform, it produces on average 1,200 percent more shares than a post that is merely text and images. If you can manage a live stream, all the better.

Fortnite Statistics

Launched late in 2017, it didn’t take long for Fortnite to become a phenomenal success. Most people have at least heard of the multi-player game, even if they are a bit fuzzy on the details and don’t understand why it’s such a big deal.

A studio called Epic Games created a series of Fortnite video games. Players bought the original iteration of the game for about $60. Essentially, it was a survival game. It’s set on Earth in modern times, but an apocalypse has occurred and zombies are on the hunt.

Two versions of Fortnite are now available and among the most popular video games on the planet. One is Fortnite: Save the World, which is a team-based game, while Fortnite: Battle Royale is all about being the last warrior standing.

While Fortnite: Save the World has undoubtedly been successful, it is Fortnite: Battle Royale that has become the real champion of the gaming world. This version is free to play, but players have a choice of an incredible array of in-app purchases that they may make.

So, how big is Fortnite, and how much money is it really raking in?

- As of May 2018, 125 million players have entered the game

- Players aged 18-24 make up the largest number of iOS players at 63 percent

- 72 percent of all players are male

- The average player spends between six and 10 hours on the game during the week

- A full 70 percent of players have made in-app purchases

- $85 is the most common total amount of purchases per player

- A famous player who goes by the name Ninja earns approximately $500,000 per month by streaming his play

- Epic Games sponsors contests, with a $100 million prize pot being available for 2020

- In June 2018, Fortnite had raked in $1.2 billion worth of revenue, including a staggering $318 million that was earned in May alone of that year

- Epic Games nearly doubled their value between July and October 2018, going from a worth of $8 billion to $15 billion

- The iOS launch soon had Fortnite bringing in one million dollars in revenue every day

Other free-to-play games are having difficulty competing with Fortnite. Fortnite’s best month reported so far showed revenue of $318 million. The closest competitor was Lineage M, which earned $223.6 million in July 2017.

A similar number, $222.7 million, was reported by Dungeon Fighter Online in March 2018. Distant fourth and fifth spots go to League of Legends with $207.6 million in November 2016 and Pokemon Go with $203.5 million in August 2016.

Fortnite has yet to be launched in China. With that country’s fierce devotion to games and the Internet, it seems that Epic will soon be setting even more amazing revenue records, one microtransaction at a time.

Platform Marketshare

Gaming is a huge and immensely lucrative industry. One of the reasons that it is so successful is that people have a wealth of choices when it comes to how and where they play. In the beginning, people played enormous video games in arcades.

The introduction of personal computers around the same time brought video games to the home user.

While arcades and PC games are still around, there are many more options available today. Game consoles made by Sony, Nintendo, and others frequently come to the forefront of consumer consciousness, but increasingly the platform of choice for gaming is a smartphone or tablet.

There’s simply something that’s appealing about being able to play your favorite game anytime, anywhere.

In 2016, experts valued the game market in the U.S. alone at $17.68 billion. By 2017, that number had risen to $18.4 billion. Worldwide, those numbers were approximately $93.29 billion in 2016 and $104.57 billion in 2017. What platforms are people using to play all of those games?

Sources suggest that in 2016, 76 percent of gamers preferred playing on a mobile device while other gamers preferred a PC or Mac, social or online games or console games.

Another way to determine which platforms gamers prefer is to look at where software developers are spending their time, money and effort. The company that puts on the Game Developers Conference every year, UBM, spent some time looking into that question.

They surveyed 4,000 developers, learning that around 66 percent of them were currently creating a game for PC play. That makes PCs the most robust platform for gaming, and the same developers also said that they believe that PCs offer the most interesting platform for gaming.

Coming in at second place was the PlayStation 4. Approximately 38 percent of the developers polled believe that PlayStation is the most interesting platform for gaming in 2020. Thirty-one percent of the respondents are currently developing a game for the PlayStation 4.

Nintendo’s popular hybrid console, the Switch, is enjoying similar interest from developers, though fewer are actually creating software for this platform. The Xbox One is another contender in the console field. About 28 percent of the respondents said that they were most interested in this platform with an equal number saying that they are currently working on a game for it.

One of the biggest growth markets for gaming involves mobile and social games. Thirty-eight percent of the survey respondents are currently developing a game for a mobile platform with approximately 30 percent saying that this platform is the most exciting one in 2020.

In 2018, NewZoo projected that approximately 2.3 billion gamers around the world would spend $137.9 billion on games. Further, they predicted that most of those people would continue to play on mobile devices.

With revenues slated to come in at over $70 billion, it’s clear that mobile gaming is continuing to rise, just as it has over the last several years.

Smartphones Dominate

Most people are playing these games on their smartphone. In fact, estimates suggest that 80 percent of people who play mobile games do so on their phone. Tablets account for the remaining 20 percent of this market.

This does not mean that the market for PC and console games will become stagnant. PC games are expected to deliver a Compound Annual Growth Rate, or CAGR, of greater than four percent between 2017 and 2021. In the year 2021 alone, revenues for PC games are expected to exceed $32 billion. Competitive play and eSports are expected to be major contributing factors to this continued success.

For more stats on mobile gaming, visit our mobile gaming statistics overview.

Will Consoles Still Thrive?

NewZoo similarly predicts growth in the console market as long as publishers find creative ways to boost in-game sales. Additionally, consoles are increasingly relying on streaming and eSports to drive further revenue. Revenue of $39 billion is being forecast for the console market in 2021.

Gaming by Regions

Gaming is a big business across the globe. Even looking at just the top 20 countries for gaming revenue reveals how widespread the phenomenon is.

Top 20 Nations by Gaming Revenue

These countries represent multiple continents and numerous time zones, but they all share a love of gaming. Let’s take a closer look at the top gaming regions in the world as well as their gaming revenues and some interesting habits.

This region includes the U.S. and Canada with a combined population of 363,721,000 people. Estimates suggest that 199,868,000 of those people are gamers. This means that nearly 55 percent of people in the U.S. and Canada play video games on a regular basis.

In 2018, they generated combined gaming revenue of $32.7 billion, with $2.3 billion coming from Canada and $30.4 billion coming from the U.S. Combined, this represents nearly 24 percent of global gaming revenues in 2018. This represents a growth of 10 percent over revenues in the prior year.

Latin America

Far less is spent on gaming in Mexico, Central America, and South America. In a combined population of 650,580,000, just 234,050,000 of the people are considered gamers. This translates to roughly 36 percent of the population of Latin America being regular video game players.

People in Mexico spend more money on games than anyone else in the region, coming in at $1.6 billion for 2018. Close on their heels was Brazil with $1.5 billion in revenue. The next closest country was Argentina where spending topped off at $456 million.

Colombia and Chile round out the list of top-five countries by gaming revenue with spending of $385 million and $205 million, respectively.

With total revenues of $5 billion, Latin America accounts for 3.6 percent of global gaming revenues in 2018. However, this represents a growth of 13.5 percent over the previous year, demonstrating that Latin America is bound to continue to be expanding marketing in the coming years.

Western Europe

This region boasts a population of 408,943,000 with 206,961,000 or just over half of those people being video gamers. In 2018, German gamers generated the most revenue in the region at $4.78 billion. The U.K. was a close second at $4.5 billion. France’s population created revenues of $3.1 billion in 2018 while Spain and Italy each reported $2 billion in revenue.

With a total 2018 revenue of $20 billion, Western Europe represented a 14.5 percent share of global gaming revenue. That translates to a 5.6 percent growth over 2017.

Eastern Europe

Revenues in this region were less robust in 2018 when compared with other regions in the same year. Nevertheless, they still represented growth of 9.1 percent over the prior year. With a population of 352,962,000 and the number of video gamers at 147,140,000, just under 42 percent of the people were regularly playing games.

By far the biggest revenue in the region was generated in Russia with $1.7 billion. Second-place country Poland generated just $546 million. The remaining top-five countries were Ukraine, Romania and Kazakhstan with respective revenues of $217 million, $184 million and $179 million.

Total revenues were $3.9 billion for a world share of 2.8 percent.

The Middle East and Africa

In this region, revenues for 2018 were just slightly higher than those for Eastern Europe. The entire region boasts a massive population of 1,716,242,000, yet only 330,696,000 of that number is considered gamers. This means that just over 19 percent of the population in that region plays video games.

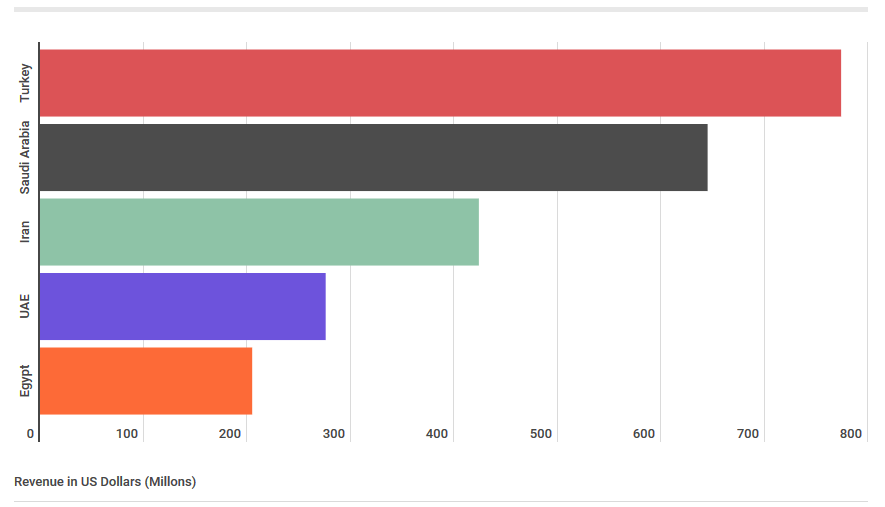

None of the top five countries in the region broke the one billion dollar mark for revenue in 2018. First-place finisher Turkey put up $878 million while second-place Saudi Arabia finished with $761 million. The remaining three spots are occupied by Iran with $602 million, the United Arab Emirates with $313 million and Egypt with $287 million.

The Middle East & Africa Gaming Revenue

Total revenues were $4.9 billion for a 3.6 percent share of the world’s revenue.

Asia Pacific

As the region with by far the largest population in the world, it should come as little surprise that the area including Asia Pacific nations should also have the highest number of gamers. Of a total population of 4,098,006,000, approximately 1,234,243,000 of the people are gamers.

Still, because the population is so massive, this only means that 30 percent of the population in the region calls themselves a video gamer. This suggests the possibility for massive growth in future years.

Unsurprisingly, China ranks in the first place in this region with $37.9 billion in gaming revenue for 2018. Second-place Japan trails far behind with just $19.2 billion in revenue. South Korea generated a respectable $5.6 billion, but the last two countries, Australia and Taiwan, are even farther back with identical revenues of $1.3 billion.

This all adds up to total 2018 gaming revenue for the Asia Pacific region of $71.4 billion. Marking a 16.8 percent growth over the previous year, it seems likely that this trend will continue for the next several years.

Asia Pacific Gaming Revenue

Overall, this region accounted for 51.8 percent of the world’s revenues for gaming in 2018. This is one region that no one in the gaming industry can afford to ignore.

PC Gaming

Many of today’s adult and older video gamers grew up in an era when PC games dominated the marketplace. Some video game consoles were available like the Magnavox Odyssey, Atari’s Home Pong Console, the Commodore TV Game and the Coleco Telstar. These were popular, but many gamers insisted that the PC was the preferred platform.

This remains true of many gamers today. Of course, modern PC gamers have many more options. They may be playing in eSports tournaments, using Twitch streamers or subscribe to one of YouTube’s many gaming channels. Regardless, the gaming world still revolves around the PC.

According to Ranker.com, the most popular PC game in 2018 was League of Legends. Released in 2009, this multi-player battle arena contest is free to play online. The second most popular PC game was Counter-Strike: Global Offensive.

This first-person shooter game also is available online. In third place is PlayerUnknown’s Battlegrounds. A 2017 release from PUBG, this is a battle royale game in which players parachute onto a remote island, scavenge for weapons and then fight for survival.

Other popular PC game titles in 2018 included Tom Clancy’s Rainbow Six Siege, Overwatch, and Minecraft. Of course, Fortnite also makes the list.

In 2017, projections suggested that the PC gaming industry would be valued at $28.04 billion. By 2020, that number is expected to hit $33.6 billion.

China is a huge and growing market for PC games. Chinese gamers may not own as many titles, but 20 percent of the people there have active accounts compared with just 14 percent in the U.S. PlayerUnknown’s Battlegrounds has been incredibly popular there.

In fact, studies suggest that this was frequently the first PC title purchased by Chinese players. Overwatch enjoyed similar success in China two years earlier.

Chinese and western video game players have a lot in common. They prefer many of the same titles, including those from the Grand Theft Auto series. Valve Corporation’s Steam multi-player platform brings PC gaming to both China and the West. Of the top 50 PC games on the service, 26 of the titles are the same in China and the U.S.

In the U.S., estimates suggest that 52 percent of gamers rely on their PC as their platform of choice. A study by the Entertainment Software Association suggests that worldwide, PC gamers make up 62 percent of the marketplace.

Console Gaming

In 2017, the video game console that sold the most units was the Sony PlayStation 4. Approximately 19.6 million units were sold that year. The second-place finisher was the Nintendo Switch. This console was introduced in 2017, and it sold approximately 11.85 million units in its debut year.

Rounding out the top video game console sales in 2017 were the Xbox One with 8.21 million units sold, the Nintendo 3DS with 6.19 million units sold, the Sony PlayStation Vita with 0.72 million units sold and the Xbox 360 with 0.06 million units sold.

For console gaming, the world market was valued at $28.5 million in 2018. That was an increase of 4.9 percent over 2016.

By March 2018, Wii Sports was the best selling console game of all time. Worldwide, it had sold more than 82.65 million units. However, it was the PlayStation 2 that was the most popular video game console across the globe in 2017. In excess of 157 million units of the PlayStation 2 had been sold by September 2017.

Most people still prefer to play physical console games as opposed to digital ones. Estimates suggest that the 2020 worldwide value of the gaming market for consoles will be $17,453 million for physical games with another $7,979 million for digital games.

Console games that are played online or with microtransactions are expected to grow. Revenues for such games are projected to be $3,765 million in 2020.

Mobile Gaming

Back in 2011, the worldwide mobile gaming market was small. Valued at $8.6 billion, the video game industry was mainly focused on PC and console games.

Times have changed. In 2017, mobile gaming generated revenue of closer to $59.8 billion. The following year, that number rose to $68.4 billion. Projections for 2020 put revenues at $74.4 billion. There are no signs of slowing in this industry.

Session shares for mobile gaming are becoming increasingly popular. That is especially true in the U.S. which accounts for 20 percent of all shares. Second-place India has just 13 percent of shares.

Approximately 192.2 million mobile gamers were active in the U.S. in 2017. That number is projected to rise by nine percent by 2020.

Additionally, a full 72.3 percent of people in the U.S. who regularly use a mobile phone also are gamers. This is a number that can only be expected to rise with time, at least for the next several years.

By 2021, experts estimate that the mobile gaming industry will be worth $180 billion in revenue worldwide. That is approximately half of all gaming revenue around the globe.

The most popular mobile games include Pokemon Go, Fortnite, Candy Crush Saga, ROBLOX and Toon Blast. Pokemon Go generates yearly revenue of about $526 million while Fortnite almost equals it with $510 million. The other three contenders have revenue of about $403 million, $236 million and $195 million.

Gaming Demographics

Many people assume that kids and teens make up the majority of the video game marketplace. While they are still major participants, it’s likely that their parents and grandparents are playing too.

The segment of the population that makes most video game purchases is the 18 to 24 crowd. Moreover, estimates suggest that men are approximately three times more likely to make video game-related purchases than women. Income also may play a role. People who earn more than $90,000 per year are far less likely to purchase games.

Research findings show that video game spending decreases with age. While people in the 18 to 24 bracket account for 16.3 percent of purchases, that number falls to 14 percent for the 25 to 27 bracket. In the 28 to 30 range, they account for just 12 percent of video game purchases.

People from 31 to 34 are responsible for 10.5 percent of sales, and the number drops to 8.6 percent for those aged 35 to 40. There is a slight uptick to 9.4 percent for those in the much larger 41+ age range.